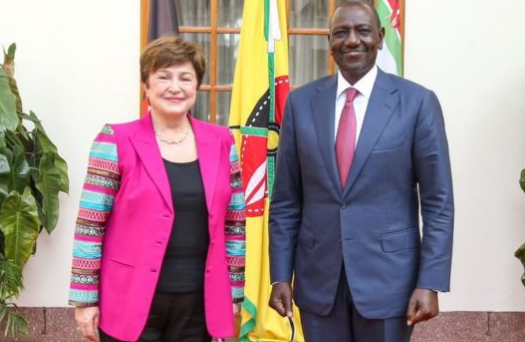

Nairobi, Kenya – In a surprising move, Kenya has terminated its loan programme with the International Monetary Fund (IMF) 10 months ahead of its scheduled expiry. This decision, announced by the National Treasury late last week, has stirred debate about Kenya’s economic independence and the potential ramifications for the nation’s financial stability.

The programme, a 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF) worth approximately $2.34 billion, was designed to support Kenya’s pandemic response and recovery efforts, while also addressing structural vulnerabilities. While Kenya qualified for a final disbursement of around $415 million, the government opted to forgo the funds.

Why Terminate the Programme?

The decision to end the programme early has been attributed to Kenya’s improved economic performance and the government’s confidence in its ability to manage its finances independently. Treasury officials cited increased revenue collection and reduced reliance on external borrowing as key factors.

“We have built a strong fiscal position, allowing us to manage our debt obligations and finance development projects without the need for further IMF support,” stated a press release from the National Treasury. “This reflects our commitment to fiscal discipline and sustainable economic growth.”

What Does this Mean for the Economy?

The termination of the IMF programme has both potential benefits and risks for the Kenyan economy:

- Reduced Dependence on International Institutions:┬ĀEnding the programme signals Kenya’s growing fiscal independence and confidence in its own economic management. This could boost investor confidence and attract foreign direct investment.

- Increased Flexibility:┬ĀWithout the IMF’s oversight, the government has greater flexibility in setting fiscal policies and prioritizing development projects. This could lead to investments in sectors deemed crucial for long-term growth.

- Potential for Increased Borrowing Costs:┬ĀThe IMF programme often acts as a seal of approval for international investors. Without this endorsement, Kenya may face higher borrowing costs when seeking funds on international markets.

- Importance of Fiscal Prudence:┬ĀThe termination puts greater emphasis on the government’s ability to maintain fiscal discipline and avoid excessive borrowing. Any deviation from prudent financial management could negatively impact investor confidence and lead to economic instability.

- Impact on the Shilling:┬ĀSome analysts predict that the absence of IMF support could put pressure on the Kenyan shilling, potentially leading to depreciation. This could increase the cost of imports and fuel inflation.

Experts Weigh In

Economic experts have offered mixed reactions to the decision.

“While it is commendable that Kenya feels confident enough to manage its finances independently, it is crucial to maintain the reforms and discipline instilled by the IMF programme,” stated Dr. Jane Mwangi, an economist at the University of Nairobi. “Without the oversight of the IMF, there is a risk of reverting to unsustainable borrowing and imprudent spending.”

Others are more optimistic. “This is a sign of Kenya’s maturing economy and its ability to chart its own course,” said Mr. David Oloo, a financial analyst. “However, the government must ensure that it maintains transparency and accountability in its financial dealings to maintain investor confidence.”

Looking Ahead

The termination of the IMF loan programme marks a significant turning point for Kenya’s economic journey. While it presents opportunities for greater autonomy and flexibility, it also underscores the importance of fiscal discipline and prudent economic management. The coming months will be crucial in determining whether Kenya can successfully navigate this new path and sustain its economic growth without the backing of the IMF. It remains to be seen if the government’s commitment to fiscal prudence will be enough to maintain investor confidence and ensure the long-term stability of the Kenyan economy.